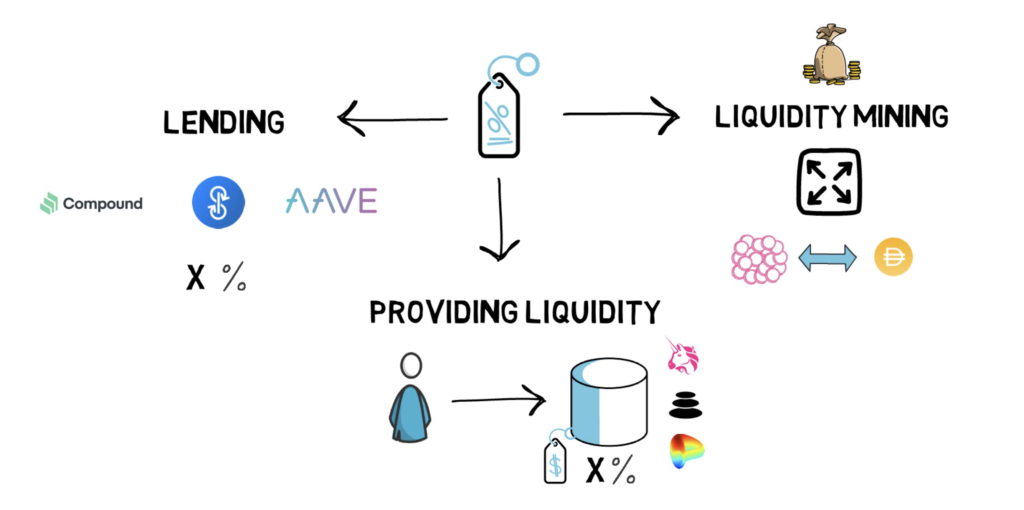

De, Fi allows anybody to engage in all sorts of monetary activities which previously required relied on intermediaries, ID confirmation and a lot of fees anonymously and totally free. One example focuses on loans. Someone installs cryptocurrency for another to borrow, and the platform this occurs on benefits them for doing so.

The mix of these rewards, coupled with the reality that the price of these in-house tokens is free-floating, allows for the potential success of financing and even borrowing to be substantial. This Is Cool practise of putting cryptocurrency to work in in this manner, often in numerous capacities at the same time, is what is called yield farming.

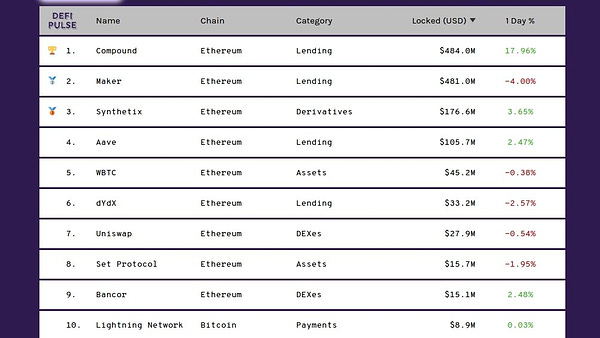

The community is fleshed out with automated trading markets computers orchestrating "pools" of tokens to guarantee that there is liquidity for any offered trade that token holders want to make. Uniswap is one of the finest known of these "automatic liquidity procedures." Curve is an example of a decentralized exchange which focuses on stablecoins such as Tether (USDT), and has its own token which borrowers and lenders can receive as a benefit for involvement supplying liquidity.

The yield farming design consists of intrinsic risk which differs depending upon the tokens used. In the loan example, cost factors to consider include the original cryptocurrency set up by a lending institution, the interest and the worth of the in-house governance token reward. Given that all three are free-floating, the revenue (or loss) potential for participants is substantial.

There are likewise secondary considerations, such as the Ether gas cost, which has actually spiked just recently, resulting in inflated deal charges for ERC-20 token transfers. What's the very best method of knowing how to yield farm with as little risk as possible? Dedicated tools exist to work out the likely cost, for instance, forecasts exchanges, which keep track of changes in non-stablecoin token costs.

With a mindful method and ideal background understanding, it is possible to keep the risk of loss to a minimum, but not remove it entirely. An useful comparison is that of the preliminary coin offering (ICO) trend from 2017, which notoriously punished opportunist financiers who put capital into projects without thorough understanding of their credibility as financial investments.